It might seem counter-intuitive, but moving in the winter—from house-hunting to getting all your worldly belongings from point A to point B—can actually be easier, cheaper and more convenient than any other time of the year. Here’s why it pays to move during the colder months.

It’s a Buyer’s Market

Spring has always been considered the best time to put a house on the market; warmer weather inspires buyers to get out and hit the open house circuit, while gardens and outdoor areas tend to show better when they’re not covered in three feet of greying snow. But there will always be sellers who need to list their homes in the dead of winter, so if you’re out there pounding the pavement while other would-be homeowners are busy hibernating, you’re at a distinct advantage. Less buyers means less bidding wars, less stress and more chances for you to score the house of your dreams.

Real Estate Agents are Less Busy

The warmer months are prime buying-and-selling times, so it makes sense that the busiest time for most real estate agents is April through September. Mid-November-February, though? Not so much. Make the most of the slow period and work with an agent who can give you 100 per cent of their attention, and help you explore all your options; you’ll both be happy when you end up with the perfect home.

Sellers are Motivated

When sellers put their houses on the market during the winter months, there’s usually a time-sensitive reason like a new job in a different city, or a baby on the way. Whatever the case, they’re often motivated to sell quickly and close the deal with minimum hassle. Luckily for you, that translates into possible savings—sellers might accept a lower offer when they’re not flooded with other options—or a closing date that fits with your schedule. The bottom line? Don’t be afraid to negotiate.

Moving Companies are Cheaper

Unlike spring and summer, when you’d have to book a rental truck or moving company weeks (or even months) in advance, it’s pretty easy to score movers and transportation in the off-season. It just happens to be cheaper, too. Moving and rental-truck companies usually offer winter discounts to entice customers, and you can even book weekends—which tends to be impossible in June, July and August—rather than take time off work to get the job done.

Tradespeople are Easier to Book

Whether you’re looking to have the interior of your new place professionally painted before you move in or need an expert to install that gorgeous vintage chandelier, you’ll have an easier time booking tradespeople in the winter than you would in the spring, summer or fall. Like movers, tradespeople tend to be less busy in the colder months, when homeowners aren’t as focused on home improvement. You won’t necessarily score crazy deals, but most painters, electricians and repair technicians will be more than happy to accommodate you.

Nows the time, give me a call and lets get shopping! 250-462-4888

The price of homes in Canada’s largest cities varies significantly less than south of the border, where Americans face an average anywhere from $86,000 to $3.3 million, new data suggests.

The data was released Thursday by RentSeeker.ca, one of Canada’s largest real estate websites, and was created with information released by the Canada Mortgage and Housing Corporation and the Canadian Real Estate Association.

Unsurprisingly, the average cost of a home in Canada this year was highest in Metro Vancouver, at $864,556. To afford a home in that range, Canadian families must bring home an annual salary of approximately $140,000.

- Based on the latest census, the median family income in Canada is $78,870. The infographic suggests that those earning the median income can afford a house priced between $460,000 and $490,000 – slightly more than half of the cost of the average home price in Metro Vancouver.

Outside of Vancouver, the next most expensive Canadian market analyzed is in Kelowna ($785,415), followed by Toronto ($755,755). Abbotsford is fourth, and Victoria is Canada’s sixth-most expensive city based on average home price.

While the prices seem high, a move to some cities south of the border would cost homeowners even more. For sake of comparison, the below prices are listed in Canadian dollars (see note below for more information on conversion).

Just south of Vancouver, the average home price in Seattle is approximately $977,000.

The most expensive city in the U.S. that RentSeeker looked at is Saratoga, Calif., where the median home price is $3,305,158.

Recent statistics from the U.S. list the average annual household income as approximately $72,000. A family bringing in the median annual income could afford a home between $398,000 and $440,000.

The top five most expensive Canadian and American markets are as follows:

- Vancouver – $864,556; Saratoga, Calif. – $3,305,158

- Kelowna, B.C. – $785,415; San Francisco, Calif. – $2,252,319

- Toronto – $755,755; San Jose, Calif. – $1,362,990

- Abbotsford, B.C. – $753,939; Brooklyn, N.Y. – $1,074,474

- Mississauga, Ont. – $640,108; Seattle, Wash. – $978,136

But heading south could also save Canadians some money, depending on where they chose to live. In some cities, like Detroit, the median home price is as low as $86,356.

The average home price in the Las Vegas area is only $377,934 Canadian.

The least expensive medians of the cities looked at are as follows:

- Fredericton – $159,370; Detroit, Mich. – $86,356

- Moncton, N.B. – $235,961; Memphis, Tenn. – $213,219

- Trois-Rivieres, Que. – $248,503; Columbus, Ohio – $246,127

- Sherbrooke, Que. – $251,387; Oklahoma City, Okla. – $263,562

- Winnipeg – $284,799; Indianapolis, Ind. – $273,096

RentSeeker looked at a sample of cities across Canada and the U.S. based on highest populations but did not list costs in the Canadian territories because the information was not readily available through the CMHC.

Canadian prices in the infographic are in Canadian dollars, and American prices are listed in U.S. dollars. For the sake of comparison, all U.S. prices have been converted to Canadian dollars in the article above, based on an exchange rate of US$0.74 per C$1 as of Thursday afternoon. Prices have not been converted in the infographic below.

The above story has been edited to reflect that the Vancouver housing price is an average of all types of homes across the Metro Vancouver area. A previous version of this article stated incorrectly that the price was the median for detached homes only.

This report, provided by the Conference Board of Canada & described as, “A new vision for housing in Canada” gets to the point of housing affordability. It’s worth the read, even a glance.

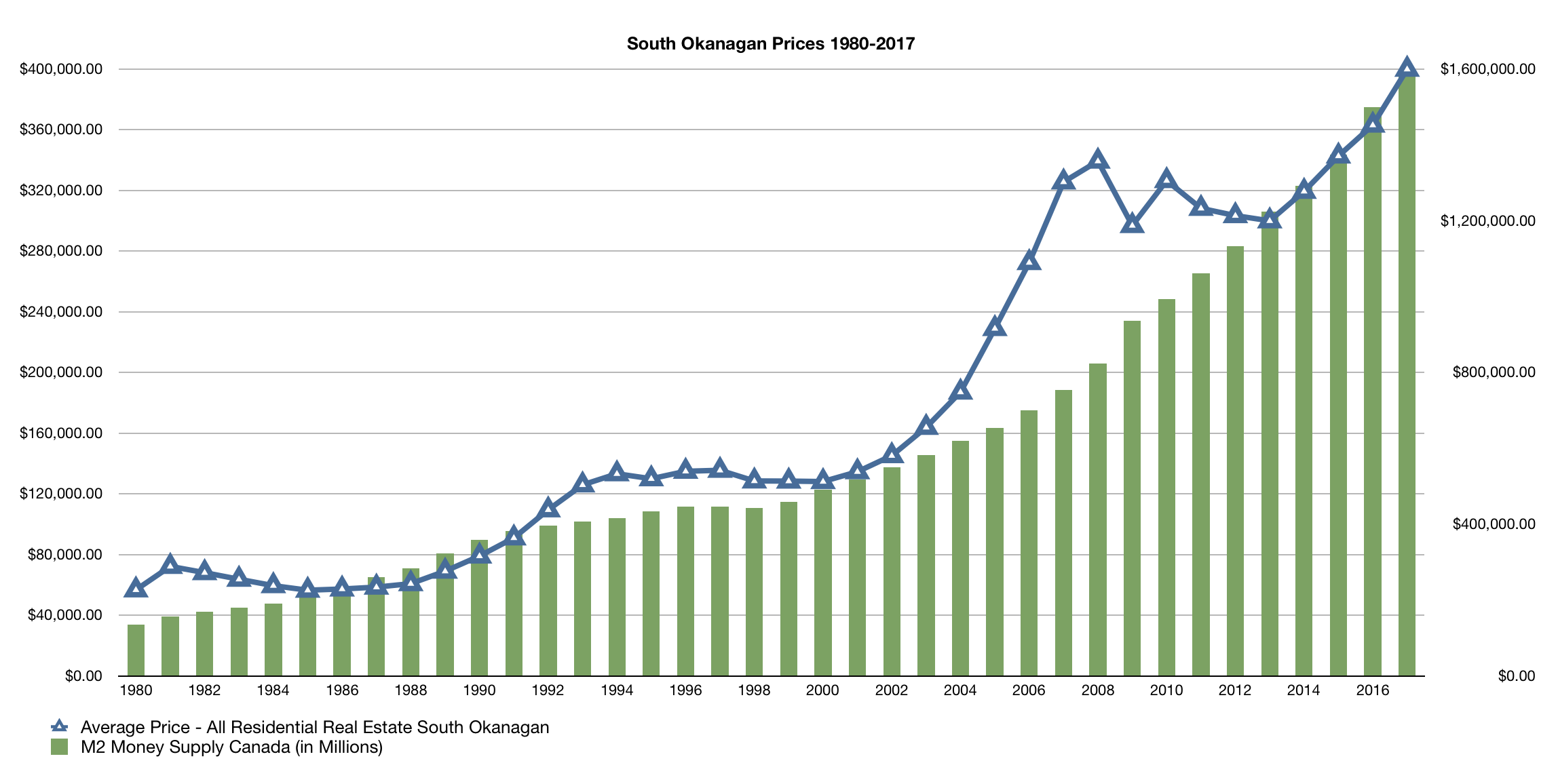

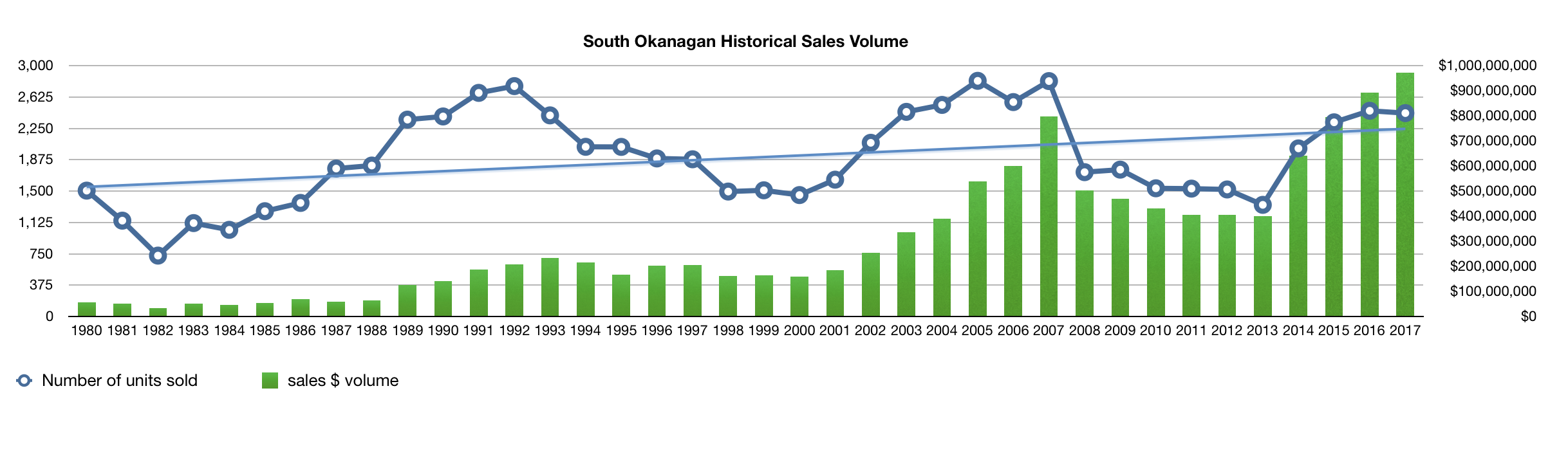

The best way to figure out where we are headed sometimes is to look in the review mirror. Where have we been? This is a look at the total volume of transactions back to 1980.

Here are historical real estate prices for the South Okanagan dating back to 1980. It gives perspective to how out of control things got leading up to 2008 & what has ensued since!

Also included in the graph is the M2 money supply of Canada, which is the broadest measurement of money circulating in Canada & a good indicator of inflation. I believe, this tends to correlate well with backstopping real estate prices, as can be seen in the graph. We have advanced significantly from 2013…

I hope you find this informative! (For larger image, right click and select open in new window)