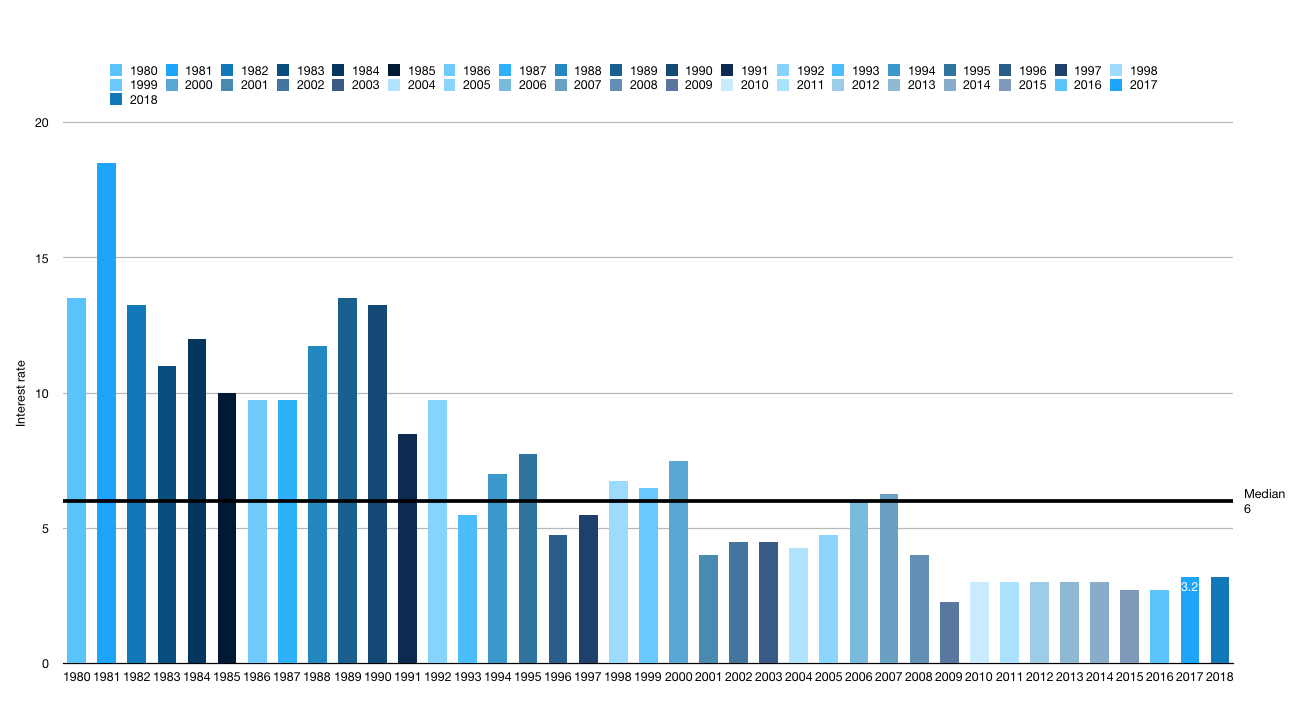

I always find it insightful to look at where we have been. This graph illustrates the interest rate landscape of the past, nearly, 40 years. (as represented by the prime lending rate, mortgage rates have indeed been higher & lower)

right click on image to open larger format in new window.

Recent times have shown the inadvisability of politicians getting involved in changing markets.

In fact, I would suggest politicians should stay away from free markets, or those with heretofore limited regulation, if we want them to remain as such.

Measures taken (never timely) simply add layers of distortion. Dismantled with great difficulty at some future date when unintended consequences mount or the inflation of previous action becomes too much to bear.

The real estate market in Vancouver was naturally correcting going into the summer of 2016. Meanwhile the BC Liberals, in their infinite wisdom decide to implement a punitive 15% tax on homes purchased in the Greater Vancouver area by foreign nationals. Largely a knee jerk reaction to popular outcry. Globally, this tax was viewed as an assault on wealthy foreign nationals, not as an effective measure against rising house prices.

Managing to tax an already cooling market is one thing… alienating and offending an entire segment of the population is another. I would think it’s unwise. We will never know what the natural peak for housing prices was going to be in the Great Vancouver Area, but had it occurred, the effects would have sent an appropriate signal to investors and a cooling phase would gain strength from organic feedback.

Now we have a new & opposite form of distortion in the market; the government will step in and provide interest free loans (*be sure to read the fine print) up to $37,500 for folks that cannot afford a healthy downpayment. Does this not compound the housing affordability issue? Instead of letting the market ebb and flow, rise and fall of its own weight, we prop up and cajole.

Don’t get me wrong, I love to see my homes’ value rise, but millions of consumers’ maturation patterns are being impeded by a single and fundamental aspect of life – shelter. Contrary to popular belief, the political meddling needs to stop. Let the market take it’s course.

Debt is debt. This lovely gift from the Liberals is more debt. Plain and simple. Once again, the onus will be on the borrower, inflated by the government and backstopped by you, the tax-payer. The 6 big banks of Canada’s lending monopoly won’t hurt equitably when this unravels. Sure their dividends will decrease but they will repossess, repackage and write off. Meanwhile, an entire generation of freshly leveraged up, tired-of-going-nowhere-millennials, will feel the sting for the next decade with their underwater mortgages, foreclosures & bankruptcies.

Market cycles have a cleansing effect over time, separating the weak from the strong. When the fundamentals are stunted or encouraged you create incalculable & amplified crisis. Meddling with the natural process eliminates the chance for rebirth, for healthy growth and true long term stability. We want ebb & flow… we don’t want crisis.

— Stability does not equal the absence of volatility, volatility is necessary —

We need politicians with backbones strong enough to tell the public, you reap what you sow. Politicians strong enough to see their powerful & aging friends, lose money. Politicians with enough patience to not distort markets for votes, when the wave of consequence is sure to last decades. With enough presence of mind to see that the average citizen can find their own way into crippling debt without government encouragement.

If we can’t achieve this, we can rest assured that the next crisis will be larger than the last.

It might seem counter-intuitive, but moving in the winter—from house-hunting to getting all your worldly belongings from point A to point B—can actually be easier, cheaper and more convenient than any other time of the year. Here’s why it pays to move during the colder months.

It’s a Buyer’s Market

Spring has always been considered the best time to put a house on the market; warmer weather inspires buyers to get out and hit the open house circuit, while gardens and outdoor areas tend to show better when they’re not covered in three feet of greying snow. But there will always be sellers who need to list their homes in the dead of winter, so if you’re out there pounding the pavement while other would-be homeowners are busy hibernating, you’re at a distinct advantage. Less buyers means less bidding wars, less stress and more chances for you to score the house of your dreams.

Real Estate Agents are Less Busy

The warmer months are prime buying-and-selling times, so it makes sense that the busiest time for most real estate agents is April through September. Mid-November-February, though? Not so much. Make the most of the slow period and work with an agent who can give you 100 per cent of their attention, and help you explore all your options; you’ll both be happy when you end up with the perfect home.

Sellers are Motivated

When sellers put their houses on the market during the winter months, there’s usually a time-sensitive reason like a new job in a different city, or a baby on the way. Whatever the case, they’re often motivated to sell quickly and close the deal with minimum hassle. Luckily for you, that translates into possible savings—sellers might accept a lower offer when they’re not flooded with other options—or a closing date that fits with your schedule. The bottom line? Don’t be afraid to negotiate.

Moving Companies are Cheaper

Unlike spring and summer, when you’d have to book a rental truck or moving company weeks (or even months) in advance, it’s pretty easy to score movers and transportation in the off-season. It just happens to be cheaper, too. Moving and rental-truck companies usually offer winter discounts to entice customers, and you can even book weekends—which tends to be impossible in June, July and August—rather than take time off work to get the job done.

Tradespeople are Easier to Book

Whether you’re looking to have the interior of your new place professionally painted before you move in or need an expert to install that gorgeous vintage chandelier, you’ll have an easier time booking tradespeople in the winter than you would in the spring, summer or fall. Like movers, tradespeople tend to be less busy in the colder months, when homeowners aren’t as focused on home improvement. You won’t necessarily score crazy deals, but most painters, electricians and repair technicians will be more than happy to accommodate you.

Nows the time, give me a call and lets get shopping! 250-462-4888

The price of homes in Canada’s largest cities varies significantly less than south of the border, where Americans face an average anywhere from $86,000 to $3.3 million, new data suggests.

The data was released Thursday by RentSeeker.ca, one of Canada’s largest real estate websites, and was created with information released by the Canada Mortgage and Housing Corporation and the Canadian Real Estate Association.

Unsurprisingly, the average cost of a home in Canada this year was highest in Metro Vancouver, at $864,556. To afford a home in that range, Canadian families must bring home an annual salary of approximately $140,000.

- Based on the latest census, the median family income in Canada is $78,870. The infographic suggests that those earning the median income can afford a house priced between $460,000 and $490,000 – slightly more than half of the cost of the average home price in Metro Vancouver.

Outside of Vancouver, the next most expensive Canadian market analyzed is in Kelowna ($785,415), followed by Toronto ($755,755). Abbotsford is fourth, and Victoria is Canada’s sixth-most expensive city based on average home price.

While the prices seem high, a move to some cities south of the border would cost homeowners even more. For sake of comparison, the below prices are listed in Canadian dollars (see note below for more information on conversion).

Just south of Vancouver, the average home price in Seattle is approximately $977,000.

The most expensive city in the U.S. that RentSeeker looked at is Saratoga, Calif., where the median home price is $3,305,158.

Recent statistics from the U.S. list the average annual household income as approximately $72,000. A family bringing in the median annual income could afford a home between $398,000 and $440,000.

The top five most expensive Canadian and American markets are as follows:

- Vancouver – $864,556; Saratoga, Calif. – $3,305,158

- Kelowna, B.C. – $785,415; San Francisco, Calif. – $2,252,319

- Toronto – $755,755; San Jose, Calif. – $1,362,990

- Abbotsford, B.C. – $753,939; Brooklyn, N.Y. – $1,074,474

- Mississauga, Ont. – $640,108; Seattle, Wash. – $978,136

But heading south could also save Canadians some money, depending on where they chose to live. In some cities, like Detroit, the median home price is as low as $86,356.

The average home price in the Las Vegas area is only $377,934 Canadian.

The least expensive medians of the cities looked at are as follows:

- Fredericton – $159,370; Detroit, Mich. – $86,356

- Moncton, N.B. – $235,961; Memphis, Tenn. – $213,219

- Trois-Rivieres, Que. – $248,503; Columbus, Ohio – $246,127

- Sherbrooke, Que. – $251,387; Oklahoma City, Okla. – $263,562

- Winnipeg – $284,799; Indianapolis, Ind. – $273,096

RentSeeker looked at a sample of cities across Canada and the U.S. based on highest populations but did not list costs in the Canadian territories because the information was not readily available through the CMHC.

Canadian prices in the infographic are in Canadian dollars, and American prices are listed in U.S. dollars. For the sake of comparison, all U.S. prices have been converted to Canadian dollars in the article above, based on an exchange rate of US$0.74 per C$1 as of Thursday afternoon. Prices have not been converted in the infographic below.

The above story has been edited to reflect that the Vancouver housing price is an average of all types of homes across the Metro Vancouver area. A previous version of this article stated incorrectly that the price was the median for detached homes only.

This report, provided by the Conference Board of Canada & described as, “A new vision for housing in Canada” gets to the point of housing affordability. It’s worth the read, even a glance.

| Changes to Assignments in Real Estate Contracts

On May 10, the BC Government amended the Real Estate Services Regulation to require changes in the way the assignment of real estate contracts are addressed. Effective on May 16, 2016, unless otherwise instructed by their clients, real estate contracts prepared by licensees must state that the contract cannot be assigned without the written consent of the seller, and that any profit from an assignment goes to the initial seller. This applies to both residential and commercial transactions, with the exception of development units (as defined in section 1 of the Real Estate Development Marketing Act – www.bclaws.ca/civix/document/id/complete/statreg/04041_01#section1). To make compliance as easy as possible for REALTORS®, BCREA will amend the related standard forms to include the following paragraph: The Seller and the Buyer agree that this Contract: (a) must not be assigned without the written consent of the Seller; and (b) the Seller is entitled to any profit resulting from an assignment of the Contract by the Buyer or any subsequent assignee. It’s important to note that buyers and sellers still have the ability to amend or entirely strike out these provisions. The point is that including this information creates an opportunity for both parties to decide how they want assignments handled. BCREA is also helping to ensure consumer awareness of the changes. On May 10, BCREA published a news release, and the Association is also supporting the Council’s efforts to help ensure consumers are aware of these changes. BCREA is the professional association for more than 20,000 REALTORS® in BC, focusing on provincial issues that impact real estate. Working with the province’s 11 real estate boards, BCREA provides continuing professional education, advocacy, economic research and standard forms to help REALTORS® provide value for their clients. To demonstrate the profession’s commitment to improving Quality of Life in BC communities, BCREA supports policies that help ensure economic vitality, provide housing opportunities, preserve the environment, protect property owners and build better communities with good schools and safe neighbourhoods. |

Prices in South Okanagan have risen 10% year over year while the number of listings remains tight, down 20% from this time last year: read more, here http://www.bcrea.bc.ca/docs/news-2016/2016-04.pdf

&

Real Estate Board of Greater Vancouver – Property Transfer Tax

Times Colonist– Budget adjusted MSP rates, cuts property transfer tax

The Vancouver Sun– B.C. budget offers help to buyers of new homes

British Columbia -Understanding Your Taxes, Property Transfer Tax

Often I enjoy looking on Houzz for inspiration for design ideas, future plans/lay outs.

Home Buyer Characteristics:

– 32% First Time Home Buyers

– Typical buyer 44 years old and median household income $86,100

– 67% Married couples, 15% single female, 9% single male, 7% unmarried couple

– 13% bought multi-generational homes with room for parents or children over 18 moving back

– 30% bought for the desire to own their own home

Home Purchased Characteristics:

– 16% bought new, 84% bought used

– 83% bought single family detached homes

– 14% bought senior housing

– Average buyer only moved 14 miles from previous home

– Buyers paid about 98% of their asking price

– Typical home 1,900 sq. feet, 3 bed, 2 bath built in 1991

– Expect to live in their home for 14 years

Home Search Process:

– Buyers took typically 10 weeks to search and viewed 10 homes before buying

– Buyers not using the internet took 5 weeks and viewed 5 homes before buying

– 59% of buyers were satisfied with their home buying process

– Buyers looked online as the first step to buying, 14% contacted agent as first step

– 87% of buyers found photos and detailed property information most important online

– 78% of buyers found their agent as a useful information source

Home Buying and Agents:

– 87% of buyers purchased through an agent

– 53% wanted their agent to help them find the right home for them

– 41% of buyers found their agent by referral

– 70% only interviewed one agent

– 86% of buyers would recommend their agent to others

Home Purchase Financing:

– 86% of buyers financed their purchase and typically 90% loan to value

– 60% of down payments came from savings, 38% equity from existing home

– 46% of buyers saved their down payment within 6 months

– 51% of buyers found it hard to save because of student loans, 47% credit card debt

– 86% see buying real estate as a good financial investment

Home Sellers:

– Average age was 54 years old, median household income $104,100

– Reasons for selling 16% too small, 14% job relocation, 13% closer to family

– Sellers lived in their home 9 years before selling

– 89% listed their home with an agent

– Sellers on average got 98% of their asking price

– Average days on market 30 days

– 37% of sellers offered buyers some kind of incentive

– Sellers on average made $40,000 more than what they paid for their home

– 61% of sellers were satisfied with the selling process

– 72% interviewed only one agent

– 91% marketed their home on MLS

– 76% of sellers paid the real estate fees

– 32% of sellers recommended their selling agent more than 3 times