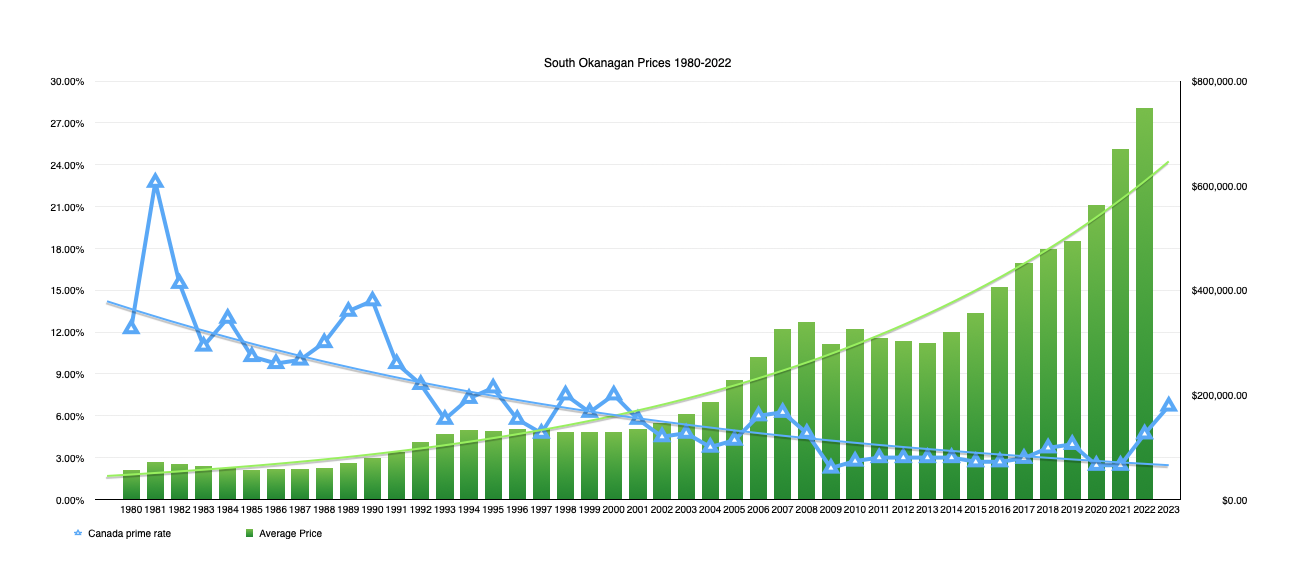

I always find it insightful to look at where we have been. This graph illustrates the interest rate landscape of the past 40+ years. As represented by the prime lending rate.

(right click and select open in new window for a larger image or if on mobile, just zoom in on your screen)

Housing starts in urban areas (areas with population of at least 10,000) in British Columbia fell by 26.1% (seasonally adjusted at annual rates) in February compared to January. The decrease was widespread with every housing type start registering declines in the month.

Across British Columbia’s census metropolitan areas, Victoria (+175.5%) was the only one in which housing starts grew in February. Kelowna saw the biggest decrease at 64.5% for the month.

Despite falling in half of the provinces, urban housing starts across Canada went up (+7.1%) in February. The increase was led by Prince Edward Island (+184.6%), Ontario (+25.8%) and Quebec (+17.2%). The increase was concentrated in apartment units (+22.8%) with all other housing types starts declining in the month. Saskatchewan (‑40.0%) registered the largest housing starts decline in February.